Travel More, Spend Less: New Venture Rewards Offer

Earn $1,200+ Towards Travel With The Capital One Venture Rewards Credit Card’s New All Time High Offer

Do you love to save money and also want to travel more?

Do you love to save money and also want to travel more?

The Capital One Venture Rewards Credit Card helps you travel for free using miles you earned from everyday purchases. For a limited time there's a new all-time high bonus offer on this card valued at over 1,200. If you've been meaning to travel more, this offer is worth checking out.

The Offer

New card members can now earn 75,000 bonus miles after spending at least $4,000 in the first 3 months (about $1,333 a month if you want to spread it out). Plus, you'll get a $250 travel credit to use in your first year. See full terms and conditions

On top of the 75,000 bonus miles, the Venture Rewards Card earns at least 2X miles on every dollar. So you'll also get 8,000 miles for the $4,000 you spent to reach the bonus—bringing you to a total of 83,000 miles, add the $250 travel credit, you're looking at over $1,200 in travel value and even more if you spend on travel. That’s enough for multiple domestic flights, like New York to Hawaii (NY-HNL) for 15,000 miles one-way, or even a round trip New York to Tel Aviv (NY-TLV) for 76,000 miles round-trip. Prices are for example and current at the time of writing. Check current offers, and pricing before applying

It's a solid start but just the beginning! Here are some things you should know about the Venture card and some useful tips on applying.

Earning Miles

The Venture Rewards Card makes earning miles simple. You’ll get 2X miles on every dollar spent—no matter what you buy. When booking through Capital One Travel, you’ll earn 5X miles per dollar. There are no limits or expiration dates for miles as long as your account is active. Just swipe and earn miles—without overthinking it.

Boost Your Earnings

If you already have a Capital One card, such as the Capital One Savor Cash Rewards Credit Card (3% cash back on dining, entertainment and more) or the Capital One Quicksilver Cash Rewards Credit Card (1.5% cash back on all purchases), you can boost your point value by transferring the earned cash back into miles and combining them with your Venture Rewards Card miles. A faster way to keep earning lots of miles.

Travel Perks & Benefits

The Venture Rewards Card comes with travel perks that make your trips smoother and more enjoyable.

● No Foreign Transaction Fees: Avoid paying extra charges (up to 3%) when you use your card abroad.

● Global Entry/TSA PreCheck Credit: Get reimbursed up to $120 every four years for application fees, letting you skip long security lines. Kids under 18 can join you in PreCheck lanes for free.

● Two Free Lounge Visits: Enjoy two complimentary passes to Capital One Lounges each year for a more comfortable travel experience.

● Hertz Five Star Elite Status: Includes upgrades, faster check-ins, and additional points on bookings.

● Free Mile Pooling: Share miles with any Capital One member for free—combine them with a spouse, family member, or friend for a bigger redemption.

● Travel Insurance: Get covered for trip cancellations, delays, and lost luggage when you pay with the Venture card.

● Rental Car Insurance: Get primary coverage internationally and secondary coverage domestically. Excludes rentals in the Republic of Ireland, Northern Ireland, Israel, and Jamaica.

● Extended Warranties: Get up to an additional year of warranty on eligible purchases.

Subject to terms and conditions

Redeeming Miles for Travel

Capital One Miles are known for being simple to earn and use. Transferring miles to travel partners generally gives you the highest payout value. However, if needed, you can also use miles to pay for Amazon purchases, buy gift cards, or redeem them as a statement credit or access exclusive events. Here are the different ways to use your miles:

1. Capital One Travel Portal: Book directly at 1 cent per mile rate. A $200 ticket would cost 20,000 points. No blackout dates or restrictions

2. Redeem For Previous Travel: Book and pay for travel using your Venture Rewards Card which will earn you 2X-5X miles. Then use miles to reimburse past travel expenses at the same 1 cent per mile rate. This way you earn miles on the purchase first instead of using points to book. A $200 ticket would earn 1,000 miles.

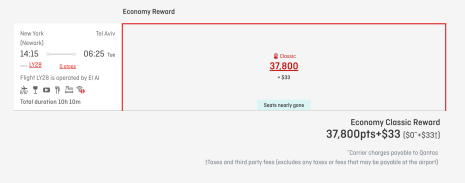

3. Travel Partner Transfer: Transfer your miles to over 18 airline and hotel partners, like Air Canada, British Airways, and Qantas, to get more value from your points. For example, a $2,400 Economy class ticket to Israel with Qantas would cost 76,000 miles, at 37,800 miles + $33 one way (See Qantas.com rewards flight screenshot below) making each mile worth 3.16 cents.

4. Cash Back: Redeem miles for 0.5 cents each as a statement credit. 10,000 miles = $50 cashback.

5. Gift Cards: Redeem miles for 1 cent each at various vendors. A $500 gift card would cost 50,000 miles.

6. Capital One Entertainment: With your Venture Rewards card, you can access tickets to sporting events, concerts, and more—from NFL and MLB games to live music performances. The redemption rate is about 0.8 cents per mile but the convenience and access to exclusive events can make it worthwhile. Plus, when you purchase tickets through Capital One Entertainment, you can earn 5 miles per dollar spent or 8% cash back if you have a Capital One Savor Rewards card.

A One Qantas Rewards flight from JFK, NY to Tel-Aviv, IL for 37,800 miles and flight is operated by El-Al. Prices are for example and current at the time of writing. Check current offers, and pricing before applying

A One Qantas Rewards flight from JFK, NY to Tel-Aviv, IL for 37,800 miles and flight is operated by El-Al. Prices are for example and current at the time of writing. Check current offers, and pricing before applying

Application Tips & Card Pointers

Credit Inquiries: Capital One pulls all three credit bureaus (Experian, Equifax, and TransUnion) when you apply.

Credit Freeze: If your credit report (Experian or Equifax) is frozen when you apply, Capital One reportedly will still approve as long as 2 of the 3 are not frozen.

Checking Your Application Status If your application is pending, call 1-800-903-9177 or 1-877-277-5901 to check the status.

Downgrade to No Annual Fee

If you’re not getting the most value from the Venture Rewards Credit Card, Capital One may allow you to switch to the Capital One VentureOne Rewards Credit Card ($0 fee, 1.25 miles per dollar), Capital One Quicksilver Cash Rewards Credit Card ($0 fee, 1.5% cash back), or Capital One Savor Cash Rewards Credit Card ($0 fee, 3% on dining and fun, 1% elsewhere).

Downgrade or close your card at least 60 days before the annual fee is charged (typically on your account anniversary) to avoid paying the fee. If you already paid the annual fee, closing the account within 30 days of the fee posting may qualify you for a refund.

To downgrade, log in to your Capital One account and look for product change options under 'I Want To…' or call customer service at 1-877-383-4802 to request a switch to an eligible no-annual-fee card.

How does the Venture Rewards Compare

Does the Venture Rewards Card truly stand out? Here's how it compares to other great credit card options.

|

Card

|

|

Annual Fee Earning Rates

|

Best For

|

|

Capital One Venture Rewards Credit Card

|

|

$95 2X all, 5X travel

|

Simple travel

rewards with a low annual fee

|

|

Capital One Venture X Rewards Credit Card

Capital One VentureOne Rewards Credit Card

|

|

$395 10X hotels/rentals, 5X flights $0 1.25X Miles on all purchases

|

Luxury travelers, higher mile earning

No-fee annual fee travel card.

|

|

Chase Sapphire Preferred

|

|

$95 3X dining, 2X travel

|

If you prefer Chase Network

|

|

Card

|

|

Annual Fee Earning Rates

|

Best For

|

The Platinum Card® from

American Express $695 5X flights & hotels Citi Double Cash $0 2% cash back

Final thoughts, Is it for you?

Premium travel perks

Flat-rate cash rewards

Choosing the Capital One Venture Rewards Credit Card isn’t just about picking a travel rewards card—it’s about getting into a flexible and rewarding system that can grow with you. Capital One has a card for just about everyone, whether you’re into travel perks, cashback, low interest rates, or need a card for your business.

For a $95 annual fee, you’re unlocking over $1,200 in travel value right away (after the initial $4,000 spend ), earning 2X miles on every purchase, access to travel perks, and if you need you can downgrade to a no-annual-fee card.

If you appreciate flexibility, generous rewards, and a hassle-free travel experience, the Venture Card could be just what you’re looking for.

Where will 75,000 miles take you?

Learn More about the Capital One Venture Rewards Credit Card →

EDITORIAL DISCLAIMER All information about Chase Sapphire Preferred and Citi Double Cash has been collected independently by PzDeals.com. Chase Sapphire Preferred and Citi Double Cash are no longer available through PzDeals.com.

All opinions, reviews, and analyses on this site are the author’s own and have not been reviewed, endorsed, or approved by any credit card companies. While we may receive compensation from some of these companies, it does not influence our opinions or recommendations.

AFFILIATE DISCLAIMER At PZ, we aim to help you save money whenever possible. We may earn a commission if you click on a link and apply for a product, but this doesn’t influence our reviews or recommendations. We're here to help you make informed choices and truly appreciate your support.

Siga con nosotros

WhatsAppo

para recibir notificaciones instantáneas sobre las mejores ofertas en línea, de tarjetas de crédito y de aerolíneas.

Comments